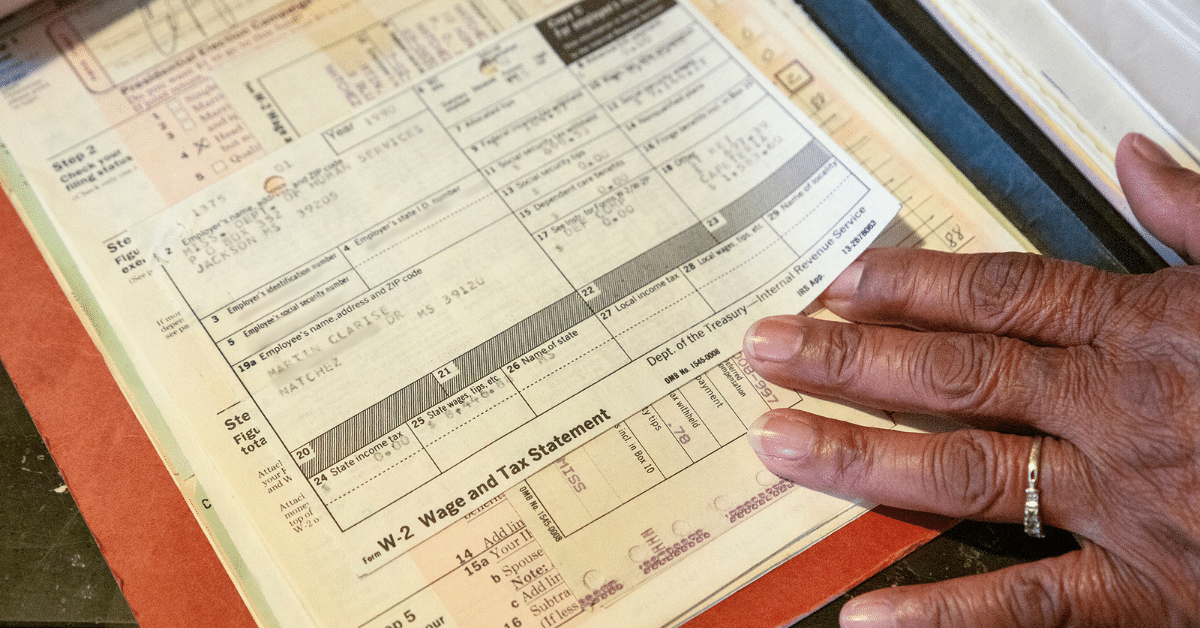

Clarise Martin takes a look at an old tax statement while in her home in Natchez Friday, January 11, 2019. Credit: Eric J. Shelton, Mississippi Today/Report For America

MS Today – Study: House tax proposal increases burden on poor Mississippians

by Bobby Harrison – features a quote from Kyra Roby

The bottom 60% of Mississippi’s income earners would be paying more taxes under legislation that has passed the House while the top 40% would be paying less, according to an analysis conducted by a Washington, D.C.-based policy think tank.

A person in the top 1% with average income of $924,000 would pay $28,610 less in combined state taxes under the sweeping legislation authored by Speaker Philip Gunn, R-Clinton, while the next 4% of state income earners would save about $3,760 in taxes on average. Based on the analysis conducted by the Institute of Taxation and Economic Policy, those earning $49,100 or above would pay less in taxes, while individuals earning less than that would pay more in state taxes than they currently are paying.

A person earning $11,000 per year would pay $220 more in taxes, while a person earning $23,000 would pay an additional $270 in taxes, based on the analysis.

Leave a Reply