This week, the Mississippi Senate released its plan for spending the American Rescue Plan Act Coronavirus State and Local Fiscal Relief Funds’ “(SLFRF)” $1.8 billion allotment to Mississippi.

As of December 13, 2021, 42 states, D.C., and Puerto Rico have already spent all or a portion of their SLFRF. Most states have used SLFRF to replace lost revenue from the pandemic. Many states have used SLFRF to respond directly to the impacts of the pandemic. Other states are using SLFRF to make transformative community investments. And some states are using SLFRF for one-time construction projects or other projects not related to the pandemic.

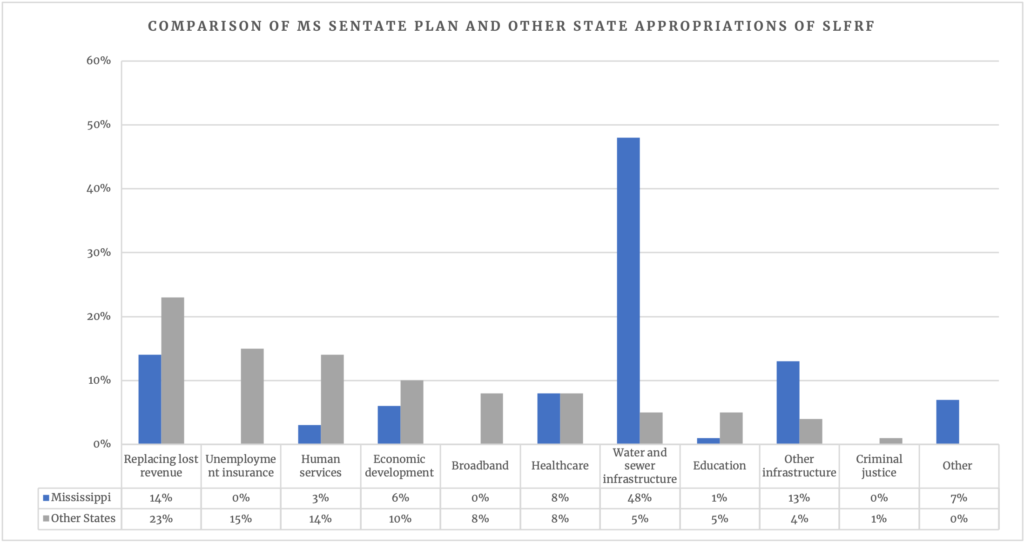

Here’s how the Senate’s plan compares to current state appropriations of SLFRF:

Under the Senate’s plan, the majority of SLFRF would be used for water, sewer, and other infrastructure projects. The Senate’s plan also includes money for workforce development, tourism, mental health services, child protective services, private colleges and universities, death benefits for law enforcement and firefighters who died from COVID-19, and other matters.

While we appreciate the Senate’s plan to move forward with the allocation of these funds, we encourage state lawmakers to consider more investments in public services such as housing, utility, income, and food assistance. For instance, state lawmakers could consider distributing funds to municipalities to build affordable housing and rehabilitate vacant lots. They could also consider targeted tax credits that will help support working families like a state Earned Income Tax Credit. We also encourage state lawmakers to use this opportunity to make much-needed investments in education, healthcare, and criminal justice reform.

Investments could include support for students whose literacy and math skills declined during the pandemic, support for college tuition costs for students in lower-income families, support for rural health centers and rural emergency preparedness, and support for more community-based youth programs. State lawmakers should also consider more equitable, revenue raising tax and budget policies—that does not include the elimination of the state individual income tax—to support these investments and make the most of this one-time federal stimulus.

One Voice will continue to monitor and analyze SLFRF spending decisions as we advocate for proposals that help create transformative investments in public services and that help strengthen economic mobility and racial equity for all Mississippians.

For more information about SLFRF, see our full report. For further reading, check out the Center on Budget and Policy Priorities’ report on state SLFRF uses here.

Our mission is to ensure an equal voice for traditionally silenced communities. When One Voice’s work is done, we envision a Mississippi with a healthy vibrant thriving neighborhoods, schools, economy, and most importantly families.

123 Main Street

New York, NY 10001

One Vision. One Village. One Voice